Parish Giving Scheme

How it works

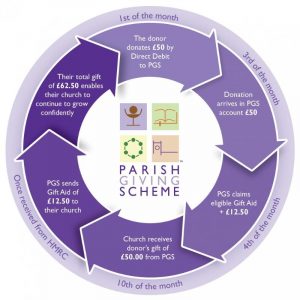

Donors can set up a Direct Debit with PGS online, over the phone or by filling in a gift form at church. This can be made on a monthly, quarterly or annual basis. Each donation is restricted to the parish church chosen by the you and cannot be used elsewhere. The donation will be passed back to the church of your choice by 10th of the month. Any eligible Gift Aid will be sent separately once it has been received from HMRC.

A unique feature of the scheme is the option for you to commit in principle to increase your gift annually in line with inflation. This is entirely at your discretion on an opt-in basis, but it is proving popular – with more than 55% of the cash received currently index-linked.

How is Gift Aid claimed?

The donation is claimed through the Parish Giving Scheme and will be passed back to the parishes bank account by the 10th of the month. Any eligible Gift Aid will be sent separately once PGS has received it from HMRC (this usually takes 5–8 working days).

PGS is a charity and therefore the Gift Aid declaration is made to, and held by, the charity. If HMRC audits a church, they will audit PGS for all its PGS donations to that church. However, you will still have to claim Gift Aid for any other donations received directly by your parish.

If you become eligible to claim Gift Aid after starting your donation through the Parish Giving Scheme, you must complete a PGS Gift Aid Declaration.

To register online to the Parish Giving Scheme please follow the link below:

Parish Giving-Holy Spirit, Southway